In our last blog, we explored FingerPost Consulting’s interest in conducting a post-pandemic Market Access Professionals survey to follow on from the Freelancers survey we conducted in 2019. As anticipated, the results gave us some predictable and some surprising information in equal measure!

The survey attracted 97 respondents, the majority of whom (60) were working within a Market Access Consultancy business, be that permanent, contract or freelance. The remaining 37, hailed from Industry with the majority of this group (28) holding permanent roles. As we anticipated, the survey’s opening questions on salary demonstrated that permanent Industry roles still commanded a slightly higher annual remuneration value than those on offer in Consulting.

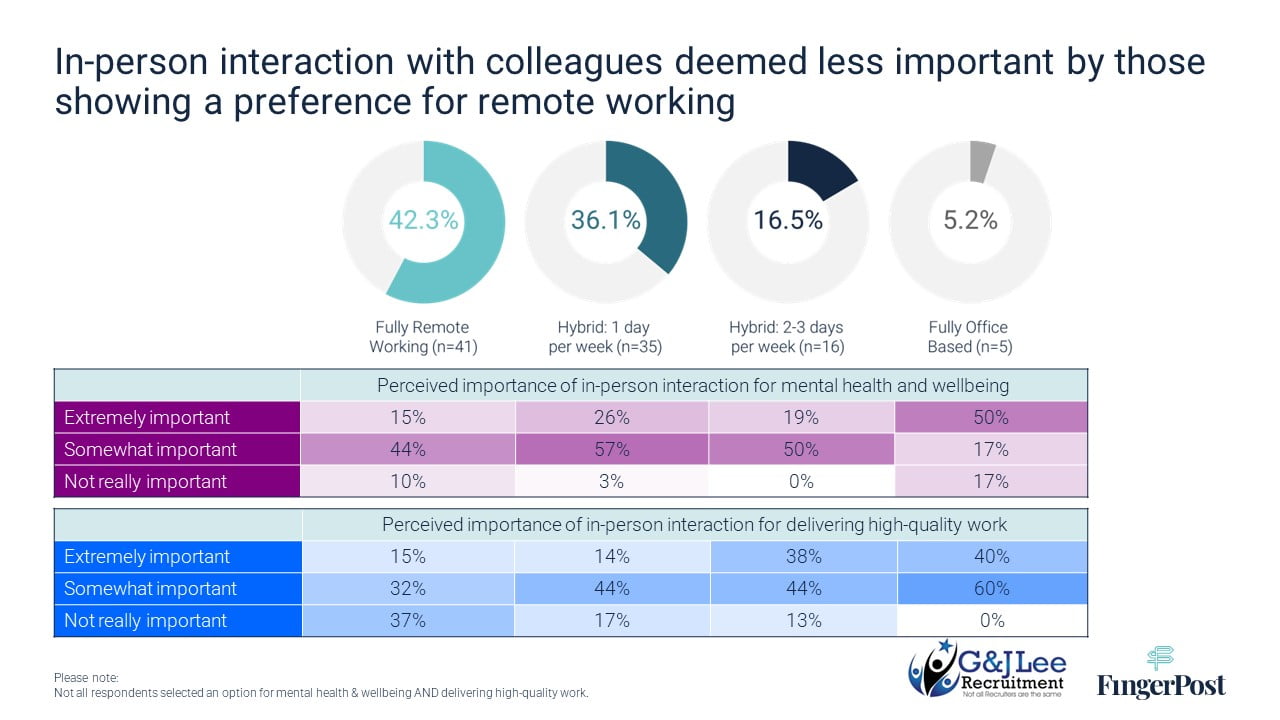

Our intentions to survey stemmed from seeing post-pandemic changes to physical working practise in the sector; this was mirrored across the sample, highlighting many subjects (42.3%) had a preference for working from home for all of their business hours, whilst only 5.2% would prefer to be office-based during these hours. These responses were underpinned by the individual’s preference for in-person interaction with colleagues, both how that impacted wellbeing at work and quality of delivery:

When asked if presented with a new job opportunity, 76% of respondents reported that remuneration was an important, or the most important aspect that drove the decision to apply. However, further questioning revealed remuneration was rarely the main reason that led to employees actually seeking new opportunities in the first instance. Therefore, it was no surprise that half of the sample confirmed they would move jobs for the same salary. These findings suggested that there were some tentative feelings about moving from a secure role in a financially disturbed market environment.

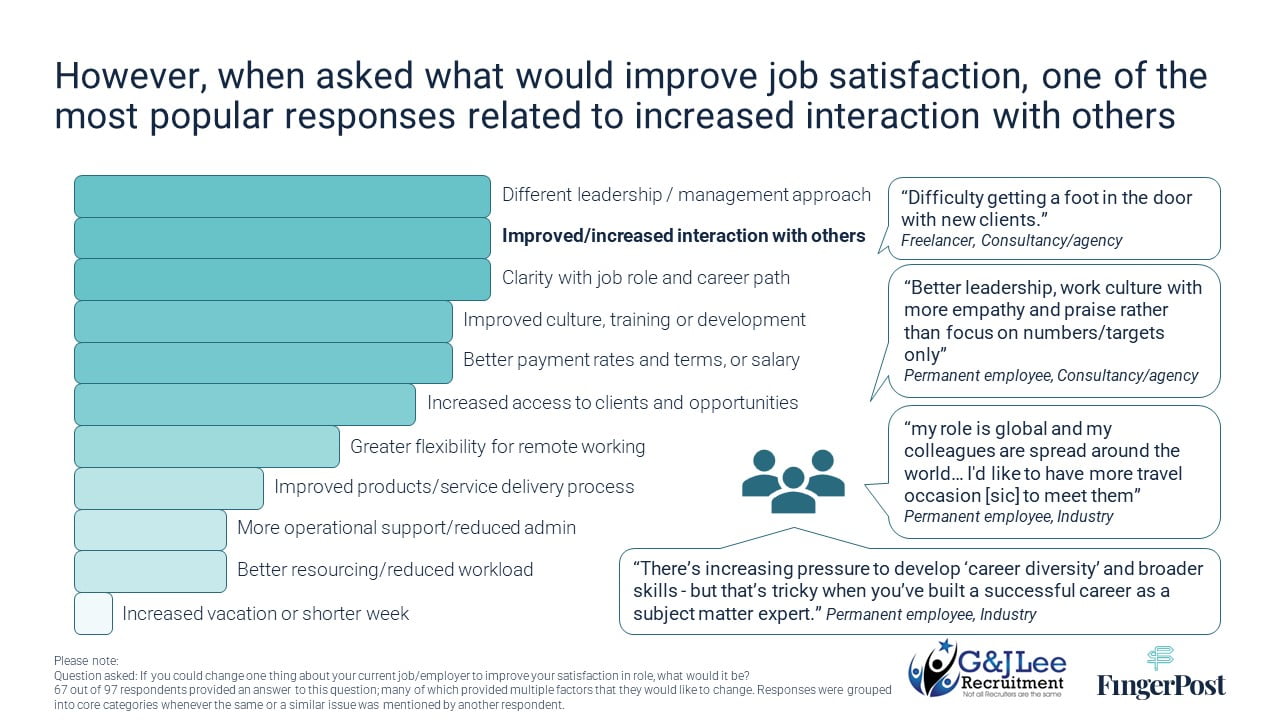

The survey moved on to ask about job satisfaction and what changes could be made to improve subjects’ enjoyment of their role. The most popular responses were found in a different leadership/management approach and improved/increased interaction with others. One respondent contextualised this with “more opportunities to travel and meet colleagues abroad”, an element that has likely changed the face of some people’s role, following pandemic restrictions.

Interestingly, in this niche sector, “Clarity with job role and career path” was the third most opted for response with one person citing, “There’s increasing pressure to develop ‘career diversity’ and broader skills – but that’s tricky when you’ve built a successful career as a subject matter expert”.

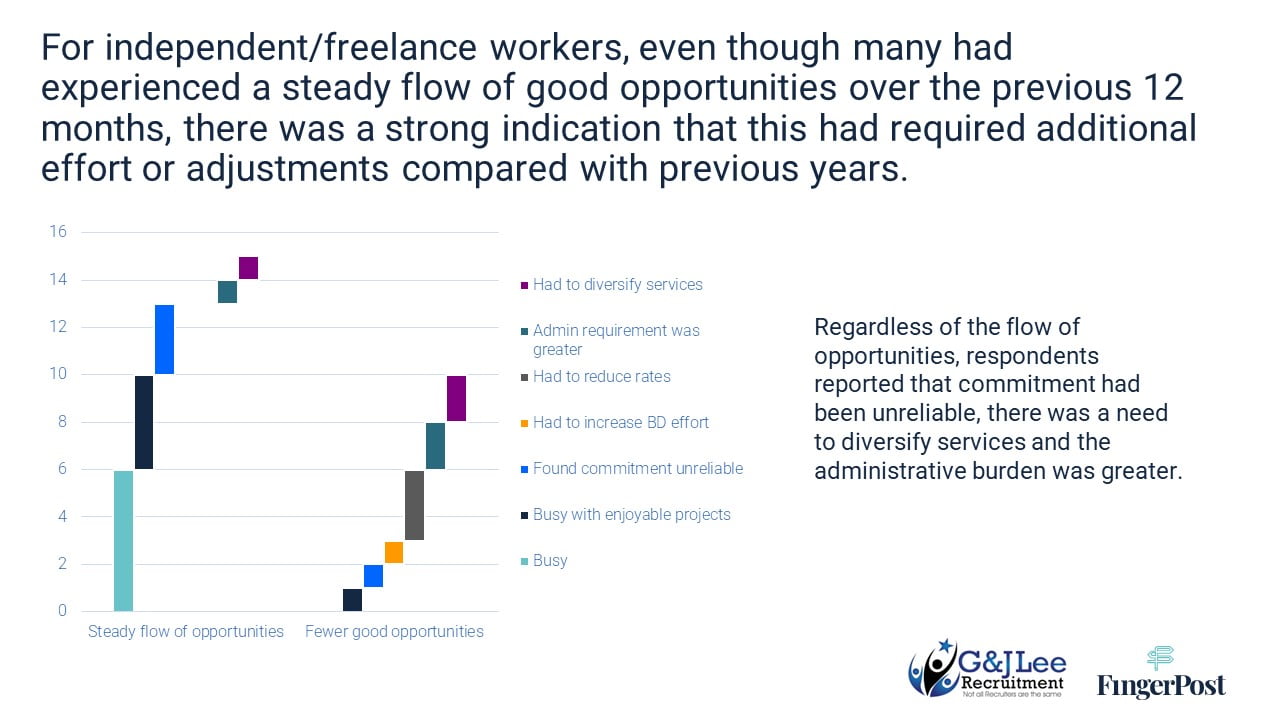

Aside from those in permanent roles, 20 of the 97 respondents were freelancers. Most had experienced a steady flow of good opportunities over the previous 12 months, however, there was a strong indication that this had required additional effort, or adjustments compared with previous years, due to work opportunities being more unreliable, needing to diversify their services to secure work and the administrative burden of being a supplier becoming greater.

Freelancer rates showed a similar distribution pattern to those found in our 2019 survey, however in 2023, some freelancers in the £150+/hour range disclosed that that they had reduced their daily or hourly rate to try to secure more work.

These findings supported our thinking in relation to the market being slightly more challenging for freelancers over the past two years. At FingerPost we have seen the market slow down post-COVID due to a number of financial, environmental and political/policy pressures on the industry. The large number of redundancies from some of the pharmaceutical giants has also pushed more Market Access professionals into the job market; some of whom have opted to give freelancing a try for a better work-life balance.

The lifestyle benefits granted due to home working in the pandemic have also been very attractive to employees as the post-Covid practicalities of these have been realised, such as eliminating commute time and cost from the working day and, for many, having more flexibilities around childcare and the ability to attend local-to-home appointments more readily.

For employers, these changes have put pressure on evaluating office versus home working operations and infrastructure, cost benefits/implications and revising company policies – understanding how fairness across a workforce is realised whilst asking what constitutes an attractive working proposition across all staff and future employees. It’s realistic to determine that the pandemic has moved most Industries into a new era of working patterns, and this is no exception for Market Access.

The 2023 survey offered up some very useful insights for FingerPost that we duly take note of when we look at our own company culture and workforce expectations. We are interested to follow up and expand upon this topic in future research with more granularity, especially when environmental influences will likely be different again, for example, changes to Cost of Living, more tech and AI in the workplace and an upturn in the Pharma Industry overall.

There were also some personal information limitations to our questions which could result in gaining a much bigger picture in future surveys, such as Gender Pay Gap insights alongside how age, gender and experience dictates working preferences; all topics that FingerPost as an equity promoting business is keen to understand.

If you would like a copy of the full report, please email: info@fingerpostconsulting.com with Market Access Professional Survey in the subject bar.